Published 04/25/2024 17:30 | Edited 04/25/2024 20:12 Prices displayed outside a supermarket in Buenos...

Journalists were prevented from staying on the floor of the luxury hotel where the...

Make a very different Easter Egg Stuffed with Pudding to sell or give as...

If it goes ahead, the merger would create a global mining giant and be...

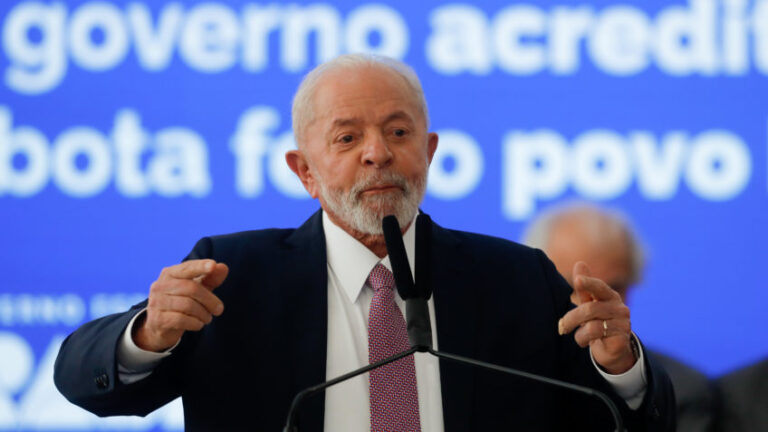

President of the PT said that the restriction was not criticized by Elon Musk...

Published 04/25/2024 08:06 Image: Carlos Alberto Santos “Your party has already faded, man.But certainlyThey...

Published 04/25/2024 08:12 | Edited 04/25/2024 08:16 Portugal celebrates today, the 25th, a historic...

In total, the company has already dismissed 50 workers who carried out an act...

Document signed by 17 countries says the release of the hostages would allow an...

During coffee with journalists, PT member said he was planning an international strategy with...

Published 04/24/2024 17:36 | Edited 04/24/2024 18:55 PRESIDENT DANIEL NOBOA VOTES IN OLÓN-SANTA ELENA,...

Argentine Security Minister criticized national march against budget adjustments for public universities Argentina’s Minister...

Region suffers from lack of supply and high prices; The proposal is to allow...

Participants in the act and authorities clashed after the university authorized action to liberate...

Published 04/24/2024 15:47 | Edited 04/24/2024 16:19 Security officers stood guard outside a Sydney...

Celso Sabino stated this Tuesday (April 23) that the government will promote the sale...

In a coffee with journalists, PT member says he hopes the US will lift...

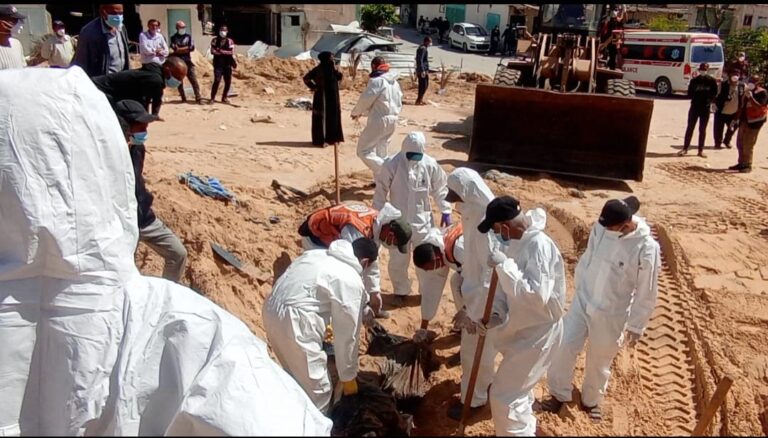

High Commissioner for Human Rights says bodies found in hospitals showed signs of torture...

Students will have the option to attend virtual classes until the end of the...

The act was organized by trade unions that oppose Javier Milei’s policies; police estimate...

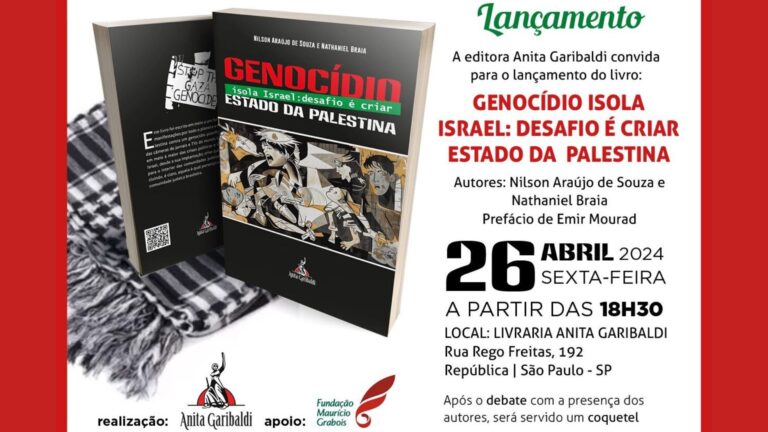

Published 04/23/2024 11:38 | Edited 04/23/2024 11:39 Next Friday (04/26), publisher Anita Garilbadi launches...

The businessman is involved in a dispute with Australian authorities over what he called...

Published 04/23/2024 18:25 | Edited 04/23/2024 20:10 This Tuesday (23), at around 4 pm,...

The IDF said it targeted members of Hezbollah; Lebanese news agency “NNA” says the...

Make a very tasty Potato Bread, just like the bakeries!

Palestinian President Mahmoud Abbas says US decision at the Security Council caused “unprecedented anger”...

Published 04/22/2024 16:52 | Edited 04/22/2024 17:13 The next few months promise to generate...

Package made up of 4 bills goes to the Senate; also demands the sale...

Published 04/22/2024 17:35 Image: QudsNen Last weekend, around 200 bodies were found in a...

Ismail Haniyeh, visited Istanbul this Saturday (Apr 20); Turkish president once again condemned Israeli...

Michael Shellenberger stated that the PF is investigating him as ordered by the minister,...

Published 04/22/2024 17:36 | Edited 04/22/2024 18:06 Next Thursday, Portugal celebrates a historic milestone...

Owner of X (former Twitter) commented on a Brazilian newspaper publication about Moraes’ loss...

Published 04/22/2024 18:48 Ecuadorians support severe measures to combat crime, but are against the...

PT President claims that businessman “openly attacked Brazilian sovereignty in favor of his interests”...

Strengthening the financing capacity of institutions of this type is one of the proposals...

“The New York Times Simulator” allows the player to create editions of the printed...

Published 04/22/2024 14:34 Drone footage following the Hamas attack shows traces of the desperation...

Brazil was the 4th country with the most demands met; data has not been...

On Thursday (April 18), the UN Security Council barred the accession of the Palestinian...

A similar maneuver was carried out by the USA, the United Kingdom and France...

Businessman responded to user who said that the broadcaster is “Brazil’s biggest problem” Businessman...

The 1st funding was made in 2023; country has a history of going to...

An editorial from Granma, official organ of the Communist Party of Cuba (PCC), reflects...

Note from the Brazilian Ministry of Foreign Affairs talks about “avoiding escalation” and does...

Make a Strawberry Stuffed Candy perfect for gifting and selling at Easter!

The case took place this Friday (April 19) in an area reserved for protesters...

Published 04/21/2024 1:41 pm President Volodimir Zelenski’s despair was not for nothing. While Russia...

The sale of Paramount Global to Skydance Media could take a turn, with the...

Businessman commented on a post about the document released by the US Congress that...