Published 07/20/2023 09:00 | Edited 07/20/2023 06:52

the british magazine The Economist highlighted in a report the prominent role that Guyana, one of the poorest countries in South America, has gained in the oil exploration scenario, in the last three years. The exploration of 0.6% of the world’s oil in Guyana takes place in the same region that has been the target of environmental questions in Petrobras prospecting: the Equatorial Margin.

He also observes that, since 2006, Petrobras has been experiencing a boom with the pre-salt discovery. Field production increased from 41,000 barrels per day in 2010 to 2.2 million barrels per day last year.

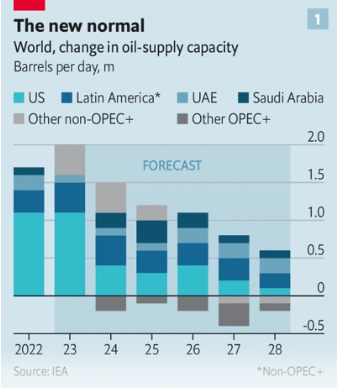

According to a recent report by the International Energy Agency, global production will increase by 5.8 million barrels per day by 2028. About a quarter of the additional supply will come from Latin America. In the midst of this, production in Argentina, Brazil and Guyana will rise and fall in the rest of the world.

According to the report, Brazil and Guyana are likely to benefit more than most exporters such as Ecuador and Venezuela that produce barrels of crude oil. The tone of the argument has a privatist bias when criticizing state-owned companies. He especially criticizes the way in which governments use the profits of oil companies, instead of keeping them applied.

According to the magazine, unlike most Gulf countries, Latin American governments in general have failed to create sovereign wealth funds to channel oil revenues into long-term investments. Instead, they have become dependent on oil as a source of foreign exchange and tax revenue. In the view of Economistoil profits should not benefit investments in the country, but be applied to an uncertain future.

The Inter-American Development Bank (IDB) considers that if the world limits global warming to 1.5 °C (which remains very unlikely), tax revenues in Latin America could be reduced cumulatively by between US$ 1.3 trillion and US$ 2.6 trillion by 2035. On the other hand, if the reserves are fully exploited, the IDB estimates that these revenues would be between US$ 2.7 trillion and US$ 6.8 trillion.

Petrobras

The pre-salt fields transformed Brazil from a minor oil producer to the eighth largest in the world. Petrobras’ technology and efficiency would be the main reasons for this advance, along with government investments. Furthermore, at US$35 per barrel, Brazil manages to make a profit in oil production, which is less than half the world price. The emission of carbon dioxide per barrel is also less than half the global average, which represents a commercial advantage in the energy transition.

In the next five years, the Equatorial Margin that runs from Amapá to Rio Grande do Norte could produce 10 billion barrels of recoverable oil, almost the equivalent of the pre-salt fields. However, the Brazilian Institute for the Environment and Renewable Natural Resources (Ibama) denied Petrobras a license to drill a well in the area. Petrobras appeals the decision.

The English report criticizes Dilma Rousseff’s management by accusing her of subsidizing domestic fuel consumption. He also defends privatization and the controversial management of Pedro Parente, who dollarized prices.

Latin America has the second largest proven oil reserves in the world, second only to the Middle East, but the article ignores how public investment was fundamental for this.

Latin America

Ignoring the US sanctions in force against Venezuela, the report tries to justify, through the governments of Hugo Chávez and Nicolás Maduro, the drop in PDVSA production from 3.4 million barrels per day in 1998 to 700 thousand barrels per day today. .

“According to Francisco Monaldi of Rice University in Houston, if all the oil in the region were exploited with the same expertise and in a regulatory environment similar to that of Texas, Latin America would be producing more oil than the US, instead of just about half”, says the text, despite the American restrictions against production in Venezuela, among other measures that they impose on companies on the continent.

In Mexico, the report criticizes left-wing president Andrés Manuel López Obrador’s investments in Pemex, the country’s state-owned oil company, to achieve self-sufficiency. “Generally speaking, Pemex now spends more of the money in the country’s coffers than it generates revenue for them,” he says.

Ecuador’s oil exploration and production tax revenue accounted for 24% of total government revenues between 2015 and 2019, according to a Boston University analysis, revealing a huge dependency. Here, government corruption would be responsible for Petroecuador’s economic problems.

Argentina increased its oil and gas production, due to sanctions on Russian oil. Rystad Energy expects shale oil production in Argentina to more than double by the end of the decade, reaching more than a million barrels a day.

Bolivia and Trinidad and Tobago depend on revenues from natural gas production for 17% of their tax revenues. However, Bolivian gas exports are expected to come to an end in 2030. In Trinidad and Tobago production has dropped by 40% since 2010.

In Colombia, the hydrocarbon extractive industry represents 50% of the country’s exports. Between 2014 and 2020, the sector absorbed 28% of all foreign direct investment. Gustavo Petro was elected last year with the promise of reducing oil exploration and has been investing in alternatives. Ecopetrol, the country’s state-owned oil company, is rapidly diversifying by investing in hydrogen production, renewable energy and electrical power transmission.

According to the magazine, along with Petrobras, Ecopetrol has been one of the most discerning state-owned oil companies when it comes to planning for the energy transition.

Source: vermelho.org.br