Published 05/24/2024 15:57 | Edited 05/24/2024 16:30

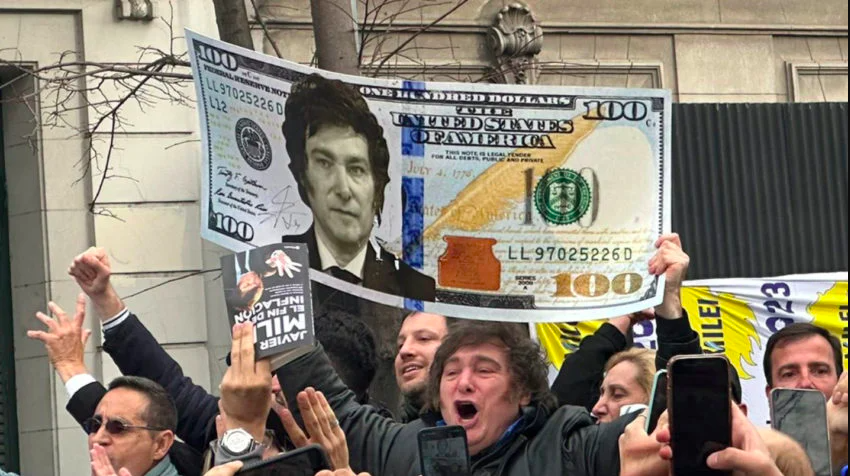

Although the Argentine economy has entered a technical recession, defined by two consecutive quarters of GDP contraction, this is not its worst challenge. This is what Argentine economist Eduardo Crespo, professor at the Federal University of Rio de Janeiro (UFRJ), assesses in an interview with Red Portal. For him, the recent exchange rate crisis, with an accelerated and strong fall in the national currency, worsens the macroeconomic management situation for the government of far-right president Javier Milei.

The Argentine economy has faced a series of significant challenges in recent months, with the devaluation of the peso on the parallel market and controversial measures by the government. Crespo offers an analysis of the factors that have contributed to the country’s current economic situation, minimizing the importance of official data, which was already predictable, to focus on exchange rate fluctuations.

The Argentine economy recorded a sharp drop of 1.4% in March, according to seasonally adjusted data from the Monthly Economic Activity Estimator (Emae), reported the National Institute of Statistics and Census (Indec). Compared to March 2023, the retraction was even more pronounced, reaching 8.4%. In the first quarter of 2024, Gross Domestic Product (GDP) fell 5.3% compared to the previous quarter.

“It was absolutely predictable, I would say, so there is nothing very surprising.” According to Crespo, the current situation was predictable due to a combination of economic factors. There was a significant fiscal adjustment, a major devaluation of the currency, and workers’ salaries did not keep up with the increase in inflation. These elements culminated in a drop in consumption and investment, resulting in a sharp recession.

Currency devaluation

Crespo highlights that, although the recession is a topic of concern, the most fundamental data in recent days is the devaluation of parallel dollars, indicating a more complicated economic situation. Interest rate reductions resulted in a price adjustment, with investors moving their positions to the dollar.

“The biggest problem that Milei has is not this predictable aspect of the strong recession for everyone, but rather this exchange rate summer, in which parallel dollars converged with the official dollar and there was a drop in country risk, etc. Now it seems to be more complicated. There was a jump in the rate of exchange rate devaluation, of parallel dollars”, he points out. “This is an announcement that there is an expectation that the situation is more complicated than previously known.”

In recent weeks, the Argentine peso has accumulated consecutive drops in the parallel market, known as the blue dollar. Yesterday, the dollar was quoted at 1,300 pesos in the informal market, registering a devaluation of more than 15% in the week, the largest since President Javier Milei took office in December. Crespo highlights that the increase in the values of parallel dollars, such as the blue dollar and the MEP dollar (Electronic Payment Market), is an indicator of an expected worsening of the economic situation, which could become an obstacle for Milei to achieve her goal of remove exchange controls.

Javier Milei’s government adopted a strategy of aggressive interest rate cuts by the Central Bank of Argentina, reducing the rate from 70% to 40% in just over a month. This measure is part of a technical approach to put an end to money issuance, identified as the main cause of chronic inflation in the country, which reached an annual rate of 289% in April.

Analysts point out that the devaluation of the peso is largely the result of these cuts in interest rates, making savings in pesos less attractive and putting upward pressure on prices on the parallel market. Furthermore, the Central Bank has not been purchasing dollars at expected levels, especially during the agricultural harvest, which worsens pressure on the currency.

Impacts and Future Expectations

The financial market estimates that as long as interest rates remain low, many small investors will continue to dollarize their portfolios. For the near future, the blue dollar is expected to continue to rise, although demand for pesos in June, due to the payment of Christmas bonuses and special bonuses, may help to curb this trend.

The exchange rate crisis in Argentina is a reflection of economic policies that, supposedly well-intentioned in an attempt to stabilize inflation, have resulted in a series of imbalances and challenges in the financial market. Eduardo Crespo’s analysis highlights the complexity of the situation and the need for balanced approaches to avoid further deterioration of the Argentine economy.

Source: vermelho.org.br