Published 09/04/2025 18:31 | Edited 09/04/2025 19:42

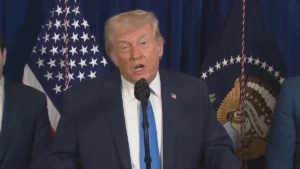

US President Donald Trump announced on Wednesday the 90-day suspension of “reciprocal” tariffs on imports from more than 75 countries except China after a violent reaction from financial markets. The Republican admitted that he felt a “little fear” on the part of his decisions and also announced the unification of all rates by 10%, so reducing the rate to countries where tariffs were higher. The tariff caused a 4.5% drop in Dow Jones in just 48 hours, and devalue the dollar and shake Asian bags.

The decision occurred after days of panic in the markets, with the income of the US Treasury titles (Treasurys) exceeding 4.5% – a sign of distrust in the government’s ability to honor debt. The truce is being celebrated, even if still under the distrust of risks of recession.

Reactions around the world

Trump’s retreated caused an immediate reaction in the financial markets: S&P 500 rose 9.5%, Dow Jones advanced 8% and Nasdaq jumped 12%, registering the highest rise since the 2008 crisis. Analysts highlight that the pressure of banks such as Goldman Sachs and JPMorgan, who warned of recession risks, was decisive for the decision to go back.

In the pharmaceutical sector, giants like Astrazeneca and Roche were impacted, as are American companies that depend on Chinese inputs. Apple has lost more than $ 300 billion in market value since the first ads. Alphabet, Amazon and Meta are also under pressure, given the possibility of new barriers to the service sector – precisely where the US maintains surplus.

Before the retreat and Canada retaliated with 25% tariffs on US products,

The Brazilian government confirmed that the measure does not change the barrier charged over Brazil, of 10%. The break, however, refers only to reciprocal tariffs and not to steel or cars.

Recession to lurking?

The reversal exposed contradictions in the White House. While Treasury Secretary Scott Bessent said the retreat was part of a plan “from the beginning,” Trump admitted that the decision was made “instinctively” to contain the turbulence.

With the contradictory statements, the US government confesses weakness by revealing hostage to the market. Trump does not yet rule out giving exemptions from tariffs to companies that need a reduction in import rates, generating even more legal insecurity. “Some companies were more affected. Let’s look at that,” he said.

Despite the momentary relief, analysts point out that the break does not solve US tax challenges. They question how to finance the $ 6 trillion promised in tax cuts without tariffs.

Volatility in markets reflects fears of economic slowdown. Companies like Walmart and Delta Airlines have already reviewed profit forecasts, citing commercial uncertainties. “With each rule change, more companies postpone investments,” explained Bart Watson of Brewers Association.

The Federal Reserve (Fed) faces a dilemma: high interest rates to contain inflation can aggravate the crisis. Analysts warn that a recession is “likely” if the trade war persists.

Source: vermelho.org.br