Published 01/29/2024 16:03 | Edited 01/30/2024 12:04

The current war in Israel is having significant impacts on the country’s economy, with costs estimated at at least one billion NIS (new Israeli shekel) or US$269 million per day. The economic scenario is projected by the global rating agency Moody’s, based on preliminary data from the Ministry of Finance.

According to Moody’s, the total cost of the war could reach between NIS 150 billion and NIS 200 billion, representing approximately 10% of the Gross Domestic Product (GDP). This figure is substantially higher than the direct costs of previous operations, such as Protective Edge in 2014 or the Second Lebanon War in 2006.

Government spending during the conflict includes significant defense expenditures to sustain the military effort, payment of salaries for hundreds of thousands of drafted reservists, compensation for businesses affected by the war, and reconstruction efforts in communities hit by recent attacks.

Moody’s highlights that tax revenues, mainly from consumption, are declining, while government spending continues to grow. The agency also notes that the Israeli economy relies heavily on the technology sector, representing 18% of GDP and contributing 50% of total exports. Around 14% of the workforce works in this sector.

The Israeli army has called up around 350,000 reservists, which is disrupting the operations of thousands of companies across the country. The absence of approximately 18% of the workforce due to the call-up of reservists, evacuation of areas close to borders and childcare due to the partial operation of schools is already putting pressure on manufacturing industries and the technology sector.

Kathrin Muehlbronner, senior vice president at Moody’s, says uncertainty persists, but the economic impact could be more severe than in previous conflicts, depending on the duration of the conflict and the long-term prospects for Israel’s internal security.

As a result of estimates of the economic impact of the war, Moody’s revised downwards its growth forecast for the Israeli economy in 2023, reducing it from 3% to 2.4%. For 2024, the agency projects a contraction of approximately 1.5%, followed by moderate growth in 2025.

Another credit rating agency, Standard & Poor’s (S&P), estimates a sharper contraction, predicting a 5% drop in the fourth quarter of 2023 for the Israeli economy. S&P projects growth of 1.5% in 2023, 0.5% in 2024 and a more significant increase of 5% in 2025.

Israel’s budget deficit is also under pressure, expected to increase to 3% of GDP in 2023 and possibly surpass 7% of GDP in 2024, according to Moody’s. The agency highlights that part of the budgetary costs related to defense can be absorbed through the redirection of other expenses and the use of budgetary reserves, but it foresees significant impacts on public finances.

Since the start of the war, Israel has raised NIS 30 billion in debt, including NIS 6 billion in dollar-denominated debt on international markets, according to data from the Ministry of Finance.

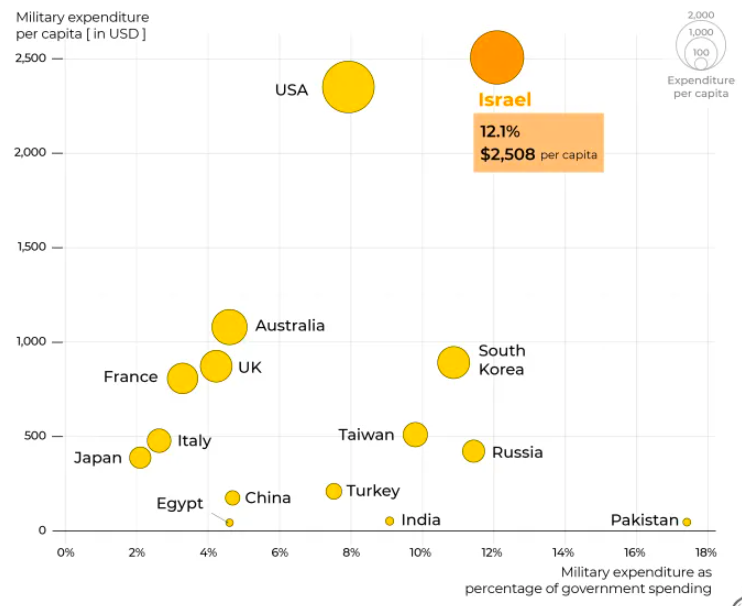

Israel operates a vast military apparatus where military service is mandatory for citizens over the age of 18. In 2020, the country spent $22 billion on its armed forces, according to a database compiled by SIPRI, a research institute focused on conflicts and weapons. Israel spent about $2,508 per capita and allocated 12% of total government spending to defense.

Comparison of military spending between countries:

The 51st. American state

The US is by far the largest provider of military aid to Israel, providing the country with a total of $3.8 billion in 2020 as part of a record $38 billion deal over a 10-year period signed under former US President Barack Obama in 2016. Previously, Israel also received substantial economic aid from the US, along with military supplies. As Israel grew richer, economic aid, which began in 1951, was gradually phased out and nearly eliminated in 2007.

By comparison, the U.S. allocated $19 million in all forms of aid to the Palestinians in 2020, according to USAID, after the Trump administration suspended most funding to the Palestinian Authority while its administration promoted a so-called “ peace plan” that the Palestinians denounced. as unilateral.

Washington is also obligated by its domestic laws, such as the US-Israel Strategic Partnership Act of 2014, to protect Israel’s so-called “qualitative military advantage,” meaning that Israel must maintain military superiority over its regional neighbors. The law guarantees Israel access to advanced US weapons. U.S. officials also regularly discuss regional defense sales with Israel to ensure that their ally is not militarily disadvantaged.

Israel has long been viewed by U.S. lawmakers as an ally to help protect U.S. strategic interests in the Middle East. Initially, this included containing Soviet influence in the region. According to the US Congressional Research Service, factors for continued military support for Israel include shared strategic interests, “US domestic support for Israel” and “a mutual commitment to democratic values.”

Source: vermelho.org.br