Published 06/25/2024 17:57

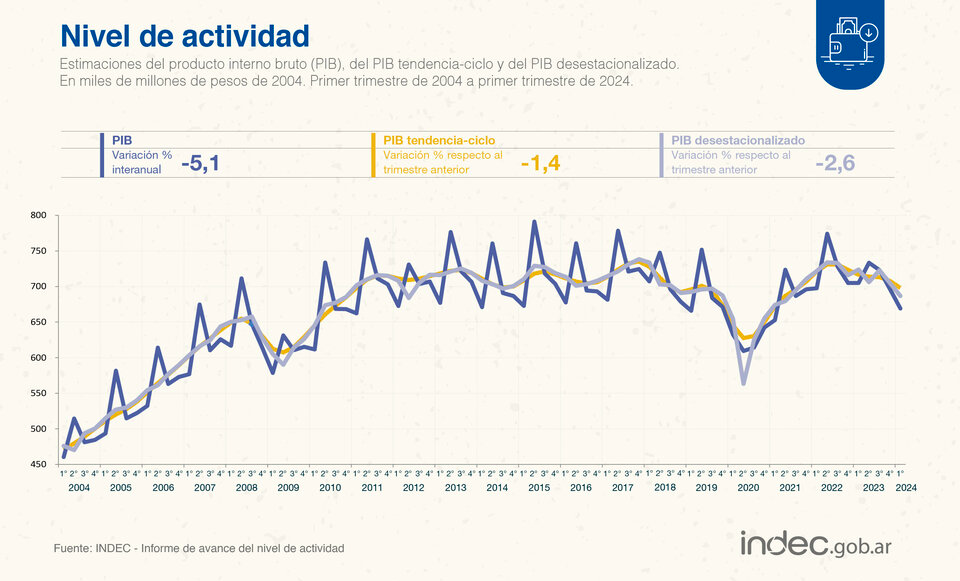

The economy in the first quarter under Javier Milei’s management showed the results of the “deepest and most accelerated adjustment in history”, as described by the president himself. Gross Domestic Product (GDP) fell 5.1% in the first three months of 2024 compared to the beginning of 2023. Compared to the previous quarter, the drop was 2.6%, adding up to a drop of 2, 5% in the fourth quarter of 2023. This indicates two consecutive quarters of recession, which is deepening and accelerating.

The recession and the deep adjustment plan in Argentina are affecting the country’s economy, with significant drops in consumption, investment and rising unemployment. In a statement to Red Portal, Argentine economist Eduardo Crespo confirms this relationship: “The fall in GDP was absolutely predictable, it was even somewhat inevitable. First, a very large fiscal adjustment”, he points out. The economist questions whether it would be possible to make a different adjustment, but the devaluation of the exchange rate and the drop in wages are also complementary factors.

Unemployment began to grow due to the drop in economic activity, reaching 7.7%, with an even more negative impact on the female population, which registered an unemployment rate of 8.4%. Analysts project that the second half of the year will see a jump in unemployment, which is expected to reach double digits (10%) before the end of 2024.

Statistics released this Monday by Indec (official institute of statistics and censuses) show a violent drop in investment of 12.6% in the quarter, while exports were the only component of demand to increase, with an increase of 11.1% %. Private consumption fell 2.6% and public consumption fell 0.8%. Thus, internal demand fell in all areas, while external demand was the only one to grow.

Impact on production

On the supply side, the productive activity that fell most in the first quarter was construction, with a drop of 19.7%, explaining the reduction in investment, which reached 23.4%. On the other hand, sectors linked to exports showed growth: agriculture and livestock increased by 10.2% and mining rose by 8%. Total exports grew 26.1% year-on-year.

This increase in exports was not driven by public policies, but rather by recovery from a historic drought in 2023 that had significantly reduced the exportable balance of grains. The December 2023 devaluation also did not have a significant impact, as most plantations had already been planted before that date.

The state of recession was also reflected in a 20.1% drop in imports compared to the first quarter of 2023. Lower domestic demand reduced the need for imported supply. Both components of GDP (global demand and global supply) shrink simultaneously when the economy enters a recession.

Devaluation exchange rate

The rise of the blue dollar to $1,365, a value that has been rising for weeks, is the result of a combination of political, economic and seasonal factors. In June, the blue dollar appreciated by $130, or 10%, exceeding the inflation projected for the month.

The pending issues regarding the Basic Law, the pressure on Central Bank reserves and doubts about a possible future devaluation are key elements in this scenario. Furthermore, falling interest rates and the 13th salary effect contribute to exchange rate volatility. In this context, investors seek protection in the dollar, further increasing its demand and raising its price to historic levels.

This devaluation had a negative impact on production and consumption. The manufacturing industry fell 13.7% in the year, while commerce (wholesale, retail and repairs) recorded a drop of 8.7%. Financial intermediation, another significant activity, saw a 13% decline.

The decline in these sectors, along with construction, largely explains the rise in unemployment. A clear example of this scenario is the announcement by Acindar de Villa Constitución (Santa Fé) that the strike at the steel plant will be drastically prolonged due to the drop in sales. The initial three-week suspension was extended to 120 to 135 days over the next six months.

In the case of small and medium-sized companies (SMEs), several sector organizations indicate that efforts to avoid layoffs have already led to suspensions. With no prospects for recovery, mass layoffs are inevitably expected in the near future.

Uncertainty factors

Volatility in the foreign exchange market is driven by a combination of political and economic factors, as well as uncertainty about the future of the government’s economic plan. The lack of definitions regarding the Basic Law and its delayed approval have changed investors’ mood in recent weeks.

The Central Bank is accumulating its lowest volume of net dollar purchases since the Milei era: just US$72 million. This is because, although private demand is high, the supply of dollars on the market is increasingly limited, which puts pressure on the Central Bank’s reserves.

The difficulty in accumulating reserves complicates the government’s projections about a quick exit from exchange control. This weakens international investors’ confidence in the government’s ability to pay. The implicit devaluation of the peso, calculated from dollar futures contracts, indicates an average of 4.3% per month until March 2025.

The abrupt drop in reference rates in pesos also puts pressure on exchange rate stability. Despite the government claiming that negative real rates are over, there are still no financial instruments that outperform inflation, leading investors to seek protection in the dollar.

The payment of the 13th salary (half a supplementary annual salary) contributes seasonally to the rise in the dollar, as many people seek to convert this payment into dollars, increasing demand and, consequently, the price of the American currency.

Source: vermelho.org.br