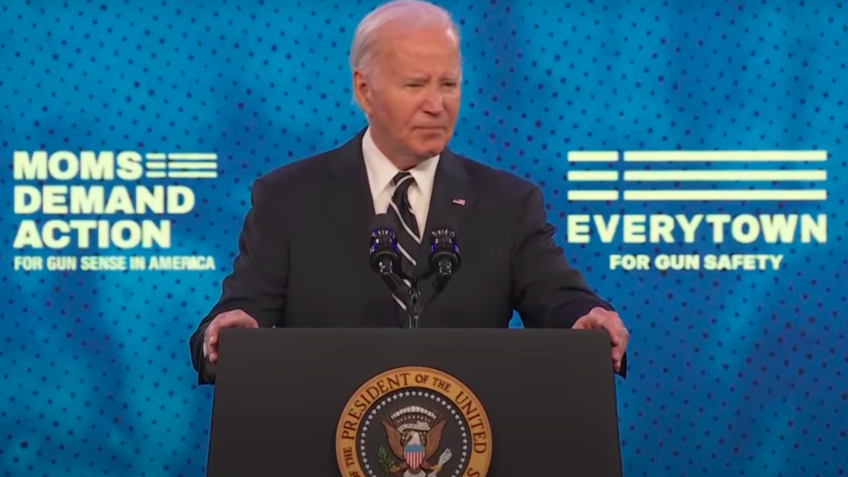

According to analysts at Strategas, a financial research firm, measures by the American president stimulate the pre-election market

The aggressive economic stimulus policies implemented by US President Joe Biden are driving the recovery of the S&P 500 this year. According to analysts at Strategas, a financial research and consultancy firm, the Democrat’s plan is to strengthen the consumer, as the presidential elections approach.

Recently, the IRS (Internal Revenue Service) and the FHFA (Federal Housing Finance Agency) launched new initiatives to strengthen the economy, considered part of a more comprehensive plan to stimulate the market before the elections.

There was a “liquidity drain” last week, when US$130 billion was removed from the market due to the increase in corporate taxes and the renewal of the “Treasure Bills”. This situation is expected to persist for another two weeks, until liquidity begins to recover in July and increases in August.

Strategas also highlights that the next presidential debate, on the 5thª fair (June 27), will be crucial for the elections. Although Biden’s approval rating and polls have shown improvement over the past week, he is still at a disadvantage. The debate is seen as a key opportunity for Biden to define the election as a choice between himself and Trump.

According to Strategas, this trend follows the pattern of presidents, who generally intensify economic measures before elections, being more active this year.

As a result, until June 21st, this year recorded the 2nd best return in S&P 500 in a presidential reelection year since 1964. In short, stocks tend to perform better in reelection years than in open presidential elections, averaging 1,300 basis points. Such standardization provides additional protection for equity markets during these periods.

With information from Investing Brasil.

Source: https://www.poder360.com.br/internacional/estimulos-de-biden-impulsionam-o-sp-500-dizem-analistas/