Published 21/06/2024 13:58

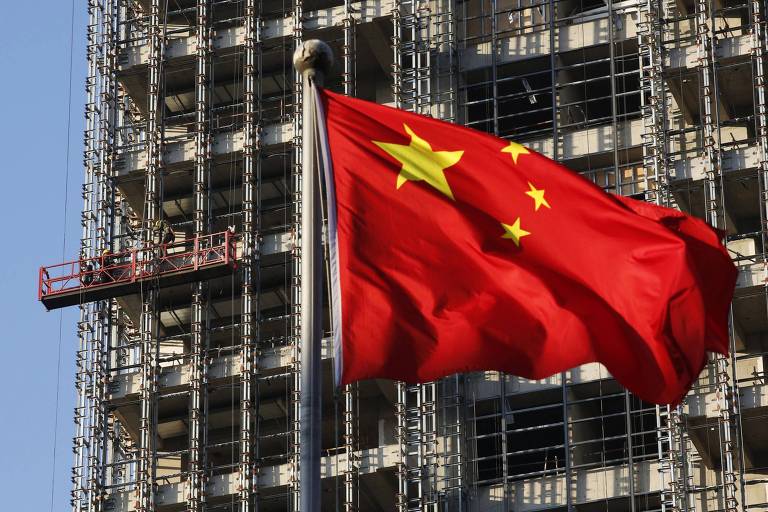

China’s real estate sector is facing a crisis that has been dragging on since 2021, when large real estate developers, such as Evergrande, ran out of cash flow to pay their debts and complete thousands of apartments that had been sold off-plan, many of them paid in advance , generating revolt among buyers who invested their savings in purchasing the properties and concern among creditor banks.

The weight of the real estate sector in the Chinese economy, which represented 12% of GDP in 2013, is expected to fall to just over 5% this year, according to projections by Hedgepoint Global Markets, the newspaper stated. The State of S. Paulo (21/5). As the article reported, “The first months of 2024 continue to show a downward trend for the real estate sector, with drops of more than 25% in residential property sales and falling investments.”

According to the Financial Times (21/5), “Goldman Sachs estimated last week that, on a cost basis, China has 30 trillion yuan in unsold housing stock, comprising land and completed apartments – the equivalent of 10 times the amount sold in the last year”. According to Goldman Sachs, in addition to the unsold housing stock, there were 90 million to 100 million “parallel supply” units in China that were often units purchased as investments and had not been inhabited.”

According to the English magazine The Economist, the apartments available for sale at the end of April were worth about 3.9 trillion yuan. According to the magazine, “Such properties are, in any case, less of a problem than the stock of unfinished, pre-sold properties or the surplus of finished, sold, but unoccupied apartments that already exist on the market. Robert Ciemniak of Real Estate Foresight, a research firm, estimates that in recent months, sales of existing homes on the secondary market have exceeded sales of new homes for the first time, at least in the nine cities for which reliable data is available. ”

To overcome the crisis, the Chinese government announced, on 17/05, a series of measures. According to the magazine The Economist (23/05), “The policy was announced on May 17 after an unusual video conference by He Lifeng, China’s economic czar. The country’s central bank will offer cheap loans worth up to 300 billion yuan ($42 billion) to 21 banks, which will in turn lend to eligible companies owned by municipal governments. These companies will use the money to buy finished but unsold apartments from property developers, including those in the private sector. The apartments can then be sold or rented at below-market prices to low-income buyers.”

Also according to the magazine, “Other initiatives include measures to stimulate private demand, such as allowing lower mortgage interest rates and initial payments. There was a new push for local governments to repurchase idle land from developers, with the proceeds from special bonds that had previously been reserved for other purposes. Authorities also urged banks to accelerate lending for a “white list” of viable but unfinished real estate projects. China must “fight the tough battle” to deal with unfinished housing projects and “promote key tasks such as…digesting existing commercial housing,” He said, in a combination of metaphors.”

According to the Estadão (21/05), “Last Friday, the People’s Bank of China announced the removal of mortgage rate floors for first and second homes and the reduction of the mortgage advance rate to a minimum of 15% for first homes and a minimum of 25% for second homes.”

According to the Financial Times (05/05) “China today announced some of its strongest measures yet to revive its debt-laden real estate sector, which has been at the center of concerns about the strength of the world’s second-largest economy. The local government will be allowed to buy some residential projects and turn them into public housing to help set a floor for falling prices, as well as buy land from struggling developers. Meanwhile, China’s central bank, which announces its next interest rate decision on Monday, has relaxed loan requirements for first-time home buyers.”

Some aspects of these measures deserve closer reflection. The first is that the set of measures adopted are guided by market principles. As noted by the Financial Times (21/5), “were evident in every measure Beijing took during the housing crisis and ultimately meant that the approach “has to be profitable or, at least, does not have to be loss-making for any government entity that is extending support.” Also according to the newspaper, “Analysts at Morgan Stanley said the new measures “strike a good balance between providing some protection and, at the same time, allowing the real estate cycle to run its course without increasing risks for local state-owned companies and banks.” Still according to the article “This is not like the great financial crisis [de 2008] where the FED goes out to buy all the troubled assets of financial institutions,” said Leonard Law, senior credit analyst at Lucror Analytics in Singapore. “What China is trying to do is much more targeted”, because “it still has to combat moral hazard and be careful not to inflate the bubble again”.

For Richard Koo, chief economist at Nomura Research Institute in Tokyo, “If the Chinese government uses the money to complete unfinished apartments, this will allow money to start circulating more quickly in the economy. Then you bring in the best and brightest people from China to create new projects that can generate a social rate of return greater than 2.4%. And why 2.4%? Because the yield on 10-year government bonds in China is 2.4%. Therefore, if the project yields more than this, it will be financially self-sustaining to pay the interest and will not become a burden on taxpayers in the future. And one of the main characteristics of a balance sheet recession is that, as the private sector deleverages, government bond yields fall to levels unthinkable in normal times. So for now, complete all the unfinished houses. In the meantime, prepare for financially viable, turnkey projects to launch in about a year. Delivering homes to these buyers will also increase confidence. Many of them put all their savings as a down payment.” (SCMP, 20/05)

The second aspect, even more relevant, is the redistributive nature of the measures taken. As Antônio Martins, from the website Outra Palavras, observed, “In the West, the Great Recession that began in 2008 in the real estate sector devastated the welfare state, multiplied the wealth of rentiers and made the fight for a roof over their head even more painful. In Spain, for example, rent started to consume an average of 40% of the younger population’s wages and as a result 64% of adults up to 35 years old are forced to continue living with their parents (it was 36% before the crisis). But to face its own real estate bubble – which led, in January, to the bankruptcy of Evergrande, a giant that had accumulated 300 billion dollars in debt –, the Chinese government is making a different way out.”

Long before the May 17 announcement, the government said it would increase social housing as part of a broader push for redistributive policies. Under its 14th five-year plan, announced in 2020, Beijing committed to providing 6.5 million government-subsidized rental homes in 40 cities. In accordance with the old Chinese maxim that crises also represent opportunities, the Chinese government realized that it could “kill two birds with one stone” by redirecting this huge stock of unoccupied properties to meet an important social objective.

Source: vermelho.org.br