Published 12/10/2024 18:35 | Edited 10/12/2024 18:48

Since assuming the presidency, Javier Milei has implemented a controversial economic agenda that provokes heated debates about its results and impacts. Policies that point to advances in financial indicators, but have generated a significant deepening of social inequalities in the country. The administration is marked by drastic cuts in public spending, market deregulation and an attempt to stabilize inflation that penalizes the most vulnerable sections of the population.

Experts differ when evaluating what many call the “successes” of the libertarian government, set against a high social cost. Despite the recession and the increase in poverty, the end of this first year of government is celebrated by the financial market, which has profited like never before from Milei’s “liberality”.

Exchange rate stabilization and fall in inflation

Argentine economist Eduardo Crespo, professor at the Federal University of Rio de Janeiro (UFRJ), points out that exchange rate stabilization and the consequent inflationary slowdown have been an achievement of Milei’s austere and recessive management. One of the strategies adopted was a controversial “money laundering”, which injected dollars into the economy and converged the country’s various exchange rates.

Having “insured the exchange rate” and the significant inflow of dollars through measures such as capital amnesty were central to the fall in inflation and the reduction of country risk. “There was a money laundering that was very successful, and this generated relief in the financial market”, explains Crespo.

According to Crespo, this measure brought immediate financial relief, although it generated a structural imbalance: “Argentina has become expensive, the dollar is cheap, and this could negatively impact tourism and external accounts next year.” The increase in the prices of food, fuel and medicine is one of the most visible reflections of regressive policies. Electricity tariffs rose 758%, while consumption fell by 11%. Essential medicines registered increases of up to 340%, especially harming retirees and chronically ill people.

Furthermore, monthly inflation, which exceeded 25% in 2023, fell to less than 3% in 2024. However, this reduction was accompanied by a significant counterpart: loss of the population’s purchasing power and an increase in poverty.

Fiscal adjustment and social impact

Julio Gambina, PhD in Social Sciences from the University of Buenos Aires (UBA) and member of the Board of Directors of the Latin American Society of Political Economy (SEPLA), classifies the “success” of the Milei government as “the achievement of the chainsaw and the blender ”. In an article to Page12he highlights that the government is marked by a lot of chainsaws and little investment.

A policy marked by a budget freeze that impacts essential areas such as health and education. “More than 40 thousand public workers were laid off, while another 160 thousand jobs disappeared in the private sector. This generated a profound deterioration in popular consumption and quality of life”, details Gambina.

The brutal cuts in public spending included:

- Reduction in the number of ministries from 18 to 9;

- Dismissal of around 200 thousand workers, including the public and private sectors;

- Budget freeze for 2024 and reduction of subsidies in transport and energy;

- Vetoes on increases for retirees.

At the same time, the budget for 2024 maintained the same levels as 2023, prioritizing investments in specific sectors such as energy and minerals, while neglecting basic social rights. The freeze on public works and cuts in transfers to the provinces deepened regional inequalities.

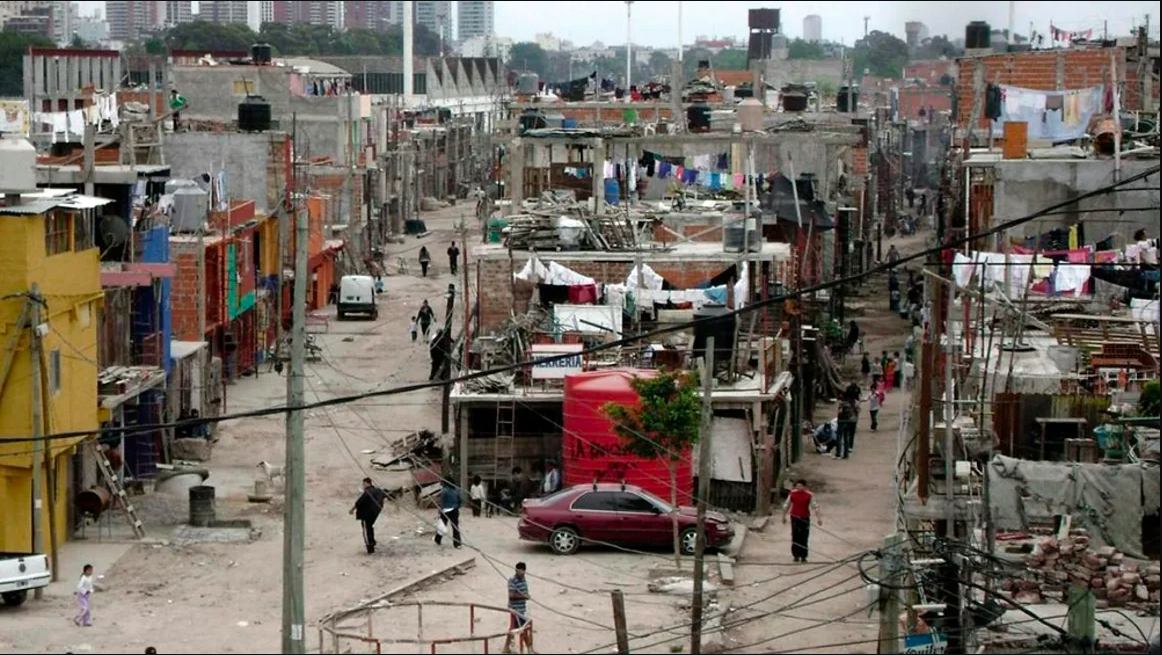

These policies resulted in an increase in monetary poverty for 52.9% of the population, worsening to more than 60% among minors, in addition to a drop in GDP between -3.5% and -4% in 2024. Unemployment also grew significantly, driven by the closure of 16,500 small and medium-sized businesses and a 12.4% contraction in manufacturing. A recession that scares even the period of the covid-19 pandemic.

Benefits for large corporations

While the population faces difficulties, large business sectors accumulate record profits. The energy sector and the agro-export complex stand out among the biggest beneficiaries:

- YPF and Tecpetrol increased their profits by 3,000% and 780%, respectively, due to sector deregulation and currency devaluation.

- The Richmond laboratory recorded a 1,325% increase in net profit in the first half of 2024, driven by rising drug prices.

- Food companies, such as Arcor, increased their profit margins by 624%, even with the drop in consumption.

In contrast, the minimum wage was adjusted by just 105%, compared to accumulated inflation estimated at 120% for 2024.

Future challengess

Although exchange rate stabilization and inflationary slowdown are celebrated, the structural challenges of the Argentine economy remain. Dollarization, one of Milei’s main campaign promises, was left aside, as was the closure of the Central Bank.

Experts warn that excessive focus on cuts and adjustments could compromise the economic recovery. Investments in infrastructure and productive sectors will be crucial for generating income and employment. Meanwhile, reducing inflation does not seem to be enough to alleviate the difficulties faced by the majority of the population.

The libertarian economic model, based on cuts, deregulation and insertion into the global market, generates profits for a few at the cost of great social suffering. Despite optimistic forecasts of 5% GDP growth for 2025, the central question is whether these gains will be distributed or whether they will continue to be concentrated in the hands of a few. For most Argentines, 2024 was a year of losses: falling income, unemployment and increasing poverty.

As Gambina warns: “It is urgent to build a new social order, without exploitation or plunder, that places collective well-being above monetary logic.”

Source: vermelho.org.br