Published 07/15/2024 16:17 | Edited 07/15/2024 17:52

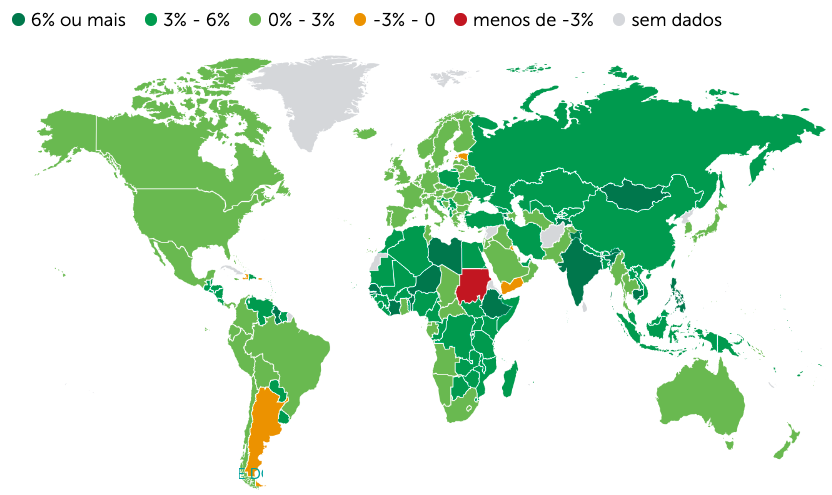

In recent years, the Chinese economy has demonstrated remarkable resilience despite growing geopolitical tensions and internal turmoil. Its quarterly growth has been approaching 5%. Although this result places China in fourth place among the fastest-growing economies in the world, the financial market and its rating agencies depreciate the Asian giant’s constant figures, well above those of the United States, for example.

With each release of the Communist Party-ruled country’s figures, Western financial media say China’s economy grew less than expected. In the second quarter of 2024, official data show growth slowing to 4.7% from 5.3% in April-June compared to the same period a year earlier, “the weakest result” since the first quarter of 2023 and “below the 5.1% forecast” made by a Reuters poll.

While the U.S. is expected to grow 2.6% in 2024, the International Monetary Fund (IMF) has praised its economic performance as “robust, dynamic and adaptable to changing global conditions.” Washington’s forecasts for its economy were also above the numbers achieved. The world’s largest economy had forecast 2.7% growth in its forecast released in April.

Read also: Russia, China and India will grow more than developed countries, says IMF

China’s economy surprises with 5.3% growth in the first quarter

China’s industrial growth in March points to greater dynamism in global trade

The long-term strategy

These analysis patterns reveal a market alignment with parameters dictated by the White House. Therefore, the Red Portal consulted economist Ticiana Alvares, a PhD candidate in International Political Economy at UFRJ, to hear what arguments explain this double standard, in which extraordinary numbers announced by the Chinese government are treated pessimistically by Western headlines. She reveals a perspective that goes beyond superficial statistics, highlighting the complex and strategic nature of Chinese growth.

According to Ticiana, “China understands the success of its development as a matter of national security.” This means that economic growth is not just a goal for financial prosperity, but is seen as essential for the country’s stability and security. In other words, for China, economic development is directly linked to its ability to maintain social cohesion, political stability and national security.

“Therefore, it has had a long-term development plan for more than four decades that is reviewed and updated every five years through the five-year plans,” says the economist. These plans are strategic documents that set economic, social and political goals, and outline the policies and investments needed to achieve them. This centralized and continuous planning approach allows China to adjust its strategies as needs and circumstances change, while maintaining a consistent focus on long-term development.

Ticiana highlights several key components of China’s development plan. This plan includes high investment rates, technological innovation, stimulation and protection of new value chains, workforce training, and strict control of capital and foreign trade.

- High Investment Rates: China invests massively in infrastructure, technology and other critical areas to sustain its growth.

- Tecnologic innovation: Promoting innovation is central to Chinese development, with an emphasis on technological advances and industrial modernization.

- Stimulating and Protecting New Value Chains: The government encourages the creation and protection of new industries and value chains, promoting strategic sectors.

- Workforce Training: There is a significant focus on education and training a skilled workforce to support the high-tech and innovation sectors.

- Capital Control and Foreign Trade: China maintains strict control over capital flows and trade policies to protect its economy and promote domestic development.

Chinese development model

For Ticiana Alvares, the Western financial market approach often “disregards China’s economic success because it is the antithesis of traditional market recipes.” This contrasts with prevailing Western economic practices and theories. While Western economies generally favor free markets and the minimization of state intervention, in the Chinese model, the state plays a central role. This is reflected in the way the country manages its investment and innovation policies, always aligned with the objectives of the five-year plans.

“In China, the State uses the market to achieve higher levels of development,” says Ticiana. For China led by Xi Jinping, the market is a tool to achieve its goals, so the production and financial systems do not operate independently.

Finally, Ticiana Alvares emphasizes that China’s development model, which combines state planning with strategic use of the market, is seen as antithetical to Western “market recipes.” However, this model has allowed China to achieve higher levels of development in a sustained and controlled manner, demonstrating a viable alternative to traditional free market approaches.

In summary, Ticiana Alvares’ analysis reveals how China implements a highly planned and state-controlled development strategy that is fundamental to its vision of national security and sustainable economic growth, contrasting significantly with Western economic models.

Recent economic performance

Economic growth in China has been uneven, with industrial output outpacing domestic consumption, fueling deflationary risks amid a housing crisis and rising local government debt. While China’s strong exports have provided some support, rising trade tensions now pose a threat. Recent data showed industrial output growth beat expectations in June but still slowed from May. On the other hand, retail sales rose just 2.0% in June from a year earlier, the slowest pace since December 2022.

The consumer sector was singled out by the press as particularly worrying, with retail sales growth hitting its lowest level in 18 months as deflationary pressures forced companies to cut prices on everything from cars to food and clothing.

The years-long housing crisis was reported to have deepened in June, with new home prices falling at the fastest pace in nine years, hurting consumer confidence and constraining the ability of already indebted local governments to generate new funds through land sales. Analysts expect debt reduction and boosting confidence to be the main focus of a key economic leadership meeting in Beijing this week, though solving one problem could make it harder to solve the other.

The government is aiming for economic growth of around 5.0% by 2024, a target that many analysts believe is ambitious and could require more stimulus. A “sharper-than-expected” growth slowdown in the second quarter prompted Goldman Sachs to cut its forecast for China’s 2024 expansion to 4.9% from 5.0%. Goldman Sachs economists said that to offset weak domestic demand, more easing will be needed through the end of this year, especially on the fiscal and housing fronts.

Quarter-on-quarter growth was 0.7 percent, down from 1.5 percent in the previous three months, according to the National Bureau of Statistics. To combat weak domestic demand and a housing crunch, China has boosted infrastructure spending and invested in high-tech manufacturing. The agency said that while bad weather took some of the hit to growth in the second quarter, the economy faced growing external uncertainty and domestic headwinds in the second half.

Ticiana Alvares’ critical analysis highlights the importance of understanding the Chinese development model in all its complexity. While Western financial markets may view China’s growth with skepticism, it is crucial to recognize that China’s approach, centered on five-year plans and strong state intervention, has enabled the country to make significant progress, even amid internal and external challenges. China’s long-term strategy can continue to be a driving force for its future development, despite the uncertainties that lie ahead.

Source: vermelho.org.br