Published 01/17/2025 18:23

China’s economy showed signs of a strong post-pandemic recovery in December 2024, exceeding market expectations in several key indicators. According to the National Statistics Office (NBS), the country’s industrial production grew 6.2% compared to the same month in 2023, above the 5.3% forecast of analysts consulted by FactSet. The result was also higher than that recorded in November, which showed an expansion of 5.4%.

In retail, sales increased 3.7% in December in the annual comparison, slightly above expectations of 3.5%. This performance also marked an acceleration compared to the 3% growth recorded in the previous month.

In monthly terms, industrial production increased 0.64% compared to November, while retail sales had a more modest increase of 0.12%.

Government stimulus

The cabinet reported “steady progress towards stability” but pointed to a “complicated and severe environment with increasing external pressures and internal difficulties”.

The statistics bureau said the economy had “remarkably recovered” in the latter part of 2024 after the government announced a series of stimulus measures. These included interest rate cuts, as well as a consumer goods swap scheme and tax incentives for property purchases.

Beijing has been trying to rebalance growth away from heavy reliance on exports and toward domestic consumption. China is expected to be hit hardest by the tariffs threatened by Donald Trump. The new US president, who will be inaugurated on Monday, has suggested he could impose a 60% blanket tax on all Chinese imports.

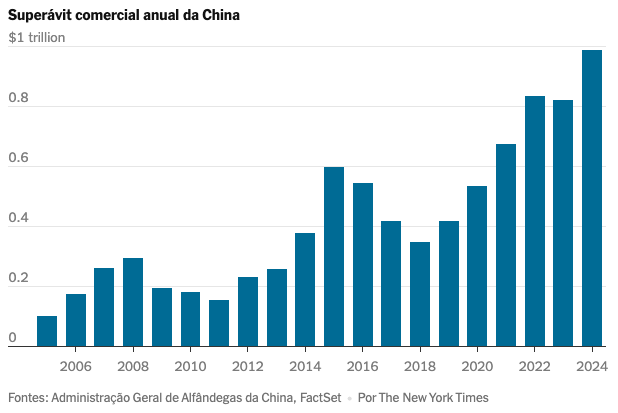

Trade surplus with historic record

China’s trade surplus reached an unprecedented milestone in 2024, surpassing the US$990 billion mark. This result reflects the global dominance of Chinese exports, which totaled US$3.58 trillion in the year, while imports totaled US$2.59 trillion. Adjusted for inflation, last year’s surplus surpassed anything recorded in the world in the last century.

This exceptional performance is largely due to increased Chinese competitiveness in sectors such as electric vehicles, solar panels and electronics. Even facing tariffs and trade barriers in several markets, the country continues to consolidate its position as the world’s largest exporter of manufactured goods.

Foreign trade was one of the main drivers of China’s economic growth in 2024, contributing about half of the country’s 5% annual GDP expansion. Chinese factories, which now produce approximately one-third of the world’s manufactured goods, have created millions of jobs for workers, engineers, designers and scientists.

Industrial transformation and self-sufficiency

China also stood out in the search for industrial self-sufficiency, in line with the “Made in China 2025” policy, which prioritizes the production of high-value-added goods, such as electric cars, lithium batteries and electronic components. This strategy led the country to surpass other exporting giants, such as Japan and Germany, becoming the largest global automobile exporter.

At the same time, the slowdown in imports reflects the national policy of reducing dependence on foreign goods. This included massive investments in infrastructure and education, which increased the training of engineers and specialized professionals, surpassing the number of graduates from US universities in various areas of science and technology.

The dizzying growth of Chinese exports has raised concerns in other countries, both developed and developing. Instead of following the Chinese recipe, they prefer to criticize the excess production capacity of Chinese factories, financed by state banks, which would “distort” prices.

In response, Wang Lingjun, vice minister of China’s General Administration of Customs, called the criticism “protectionism against China’s development.” He defended the country’s economic model as an engine of global growth.

Investments and real estate crisis

China’s fixed asset investment rose 3.2% in 2024, close to analysts’ 3.3% forecast. The real estate market is also recovering more slowly. Average prices for new homes fell 0.08% in December compared to November, but the decline was less pronounced than the 0.2% recorded in the previous month. Year-on-year, prices fell 5.7%, also an improvement on November’s 6.1% drop.

Among the 70 largest Chinese cities monitored by NBS, 43 reported falling property prices compared to December 2023, lower than the 49 recorded in November. These numbers reflect the government’s efforts to stabilize the sector after the crisis triggered by the bankruptcy of giant Evergrande.

The other positive indices have been crucial in mitigating the impacts of an internal crisis in the real estate market, which resulted in the loss of savings for millions of Chinese families and left many construction workers unemployed.

Performance of state-owned companies and strategic investment

Another highlight was the performance of state-owned companies controlled by the central government, which recorded profits of 2.6 trillion yuan (US$361.7 billion) in 2024, according to the State Assets Supervision and Administration Commission (SASAC). The assets of these companies exceeded 90 trillion yuan, an annual increase of 5.9%.

Investment in strategic emerging sectors was one of the pillars of this expansion, with an increase of 21.8%, totaling 2.7 trillion yuan. Spending on research and development remained robust, surpassing 1 trillion yuan for the third consecutive year.

Challenges and perspectives

Annual GDP growth peaked at 5% in 2024, within the official target, and well above most Western economies. The real estate crisis and low inflation, which flirts with deflation, remain points of attention.

On the other hand, recent data has strengthened market confidence. Chinese and Hong Kong stock markets had their best weeks in months, driven by better-than-expected numbers and the prospect of more favorable economic policy in 2025.

With the inauguration of Donald Trump in the United States and a global economic agenda in transition, the Chinese recovery will be closely monitored, especially in strategic sectors that can boost growth in the medium term.

Source: vermelho.org.br