Negotiations cover payments relating to currency swaps, due in June and July, with the international financial institution

During the negotiations on the Basic Law and the uncertainty regarding the next steps of the economic plan, the government of Argentine president Javier Milei is adopting strategies to cover debt maturities with China and the IMF (International Monetary Fund). In June, the economic team must pay US$2.954 billion and, in July, US$1.97 billion for the swap exchange rate with the Asian country and another US$643 million to the IMF, totaling more than US$5.5 billion.

The Argentine government is in negotiations with the IMF and China to reach this amount. The 8th review of the program by the IMF Executive Directorate, scheduled for Thursday (June 13, 2024), could release US$800 million, which would alleviate some of the financial pressure. This review is considered crucial, since, according to Julie Kozack, IMF spokesperson, “it was the first of this program in which all quantitative targets were met”.

In addition to negotiations with the IMF, the Argentine government is discussing the continuation of the currency swap with China, a delicate negotiation due to Milei’s critical statements about the Asian country, which led to concerns about the renewal of the agreement. These negotiations are fundamental for Argentina, which seeks to meet its payments without compromising its reserves, essential for the country’s economic stability.

Regarding the swap with China, there is a strict confidentiality agreement. If broken, this could harm trade relations between the 2 countries. For this reason, the economic team maintains secrecy regarding the progress of the negotiations. As this is an agreement between central banks, the BCRA (Central Bank of the Argentine Republic) is responsible for disclosing information about the swap.

Chinese swap

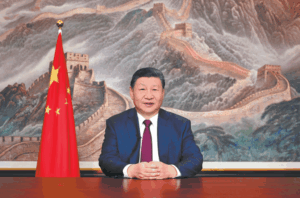

In December 2023, Milei sent a letter to Xi Jinping, asking for the Chinese president’s support to accelerate the process of renewing the swap exchange rate in yuan between countries. The initiative took place after China froze US$6.5 billion in credit granted to Argentina.

The agreement is important for Argentina because it helps the South American country pay its debts. It is also a strategy that Argentines have to increase their reserves.

In October, the Chinese Central Bank made US$6.5 billion available to Argentina from the credit line swap exchange rate. The measure was announced after the then Argentine president, Alberto Fernández, met with Xi Jinping in Beijing. The South American country used the agreement to pay, in November, part of its US$2.6 billion debt to the IMF.

Source: https://www.poder360.com.br/internacional/argentina-busca-acordos-com-fmi-e-china-para-divida-de-us-55-bilhoes/