Published 09/01/2025 16:58 | Edited 09/01/2025 18:04

China’s lithium reserves have almost tripled (from 6% to 16.5%), making the country the world’s second largest holder of the metal essential for renewable energy technologies, China’s Ministry of Natural Resources announced last Wednesday. (8). With the discovery of new deposits and technological advances in extraction, the country now holds 16.5% of global reserves, behind only Chile and surpassing Australia, Argentina and Bolivia, according to the Geological Survey of China.

This leap was made possible by discoveries in a 2,800-kilometer lithium belt that stretches across the Kunlun, Songpan and Ganzi regions in the west of the country. The belt alone has proven reserves of more than 6.5 million tons, with a resource potential of more than 30 million tons. This region also enriches China’s lithium ores diversity.

This achievement reflects not only the discovery of new deposits, but also the improvement of techniques that allow the extraction of metal from minerals previously considered unviable. Lithium is an essential element in the production of lithium-ion batteries, which power electric vehicles and electronics, sectors that are rapidly expanding in China.

Read also: Interest in Latin American lithium explains Musk’s confusion on the continent

Bolivia: Arce presents lithium industrialization plan

Chile cancels lithium privatization contract

Strategic importance of lithium

China is the largest global consumer of lithium, essential for the production of batteries and electronics, especially for electric vehicles. According to the Xinhua agency, the country sought to reduce its dependence on imports to meet growing demand. This dependence raised production costs and limited the development of sectors such as energy storage, communications and medical treatments.

Lithium’s applications go beyond batteries. Emerging industries such as energy storage, communications, medical treatments and fuels for nuclear reactors also depend on the metal. The growth of the renewable energy industry and the transition to electric vehicles have further increased global demand for this resource.

Technological advances boost extraction

The expansion of reserves has also been driven by advances in the extraction of lithium from salt lakes and lithium mica. Newly identified salt lake resources total more than 14 million tons, positioning China as the third largest salt lake lithium hub in the world, behind the Lithium Triangle in South America and the western US.

Extracting lithium from the brine of these lakes, in addition to being low cost, also has a lower environmental impact, making it a sustainable option. On the other hand, technological innovations in mica extraction overcame challenges such as high costs and complex processes, adding 10 million tons to proven reserves.

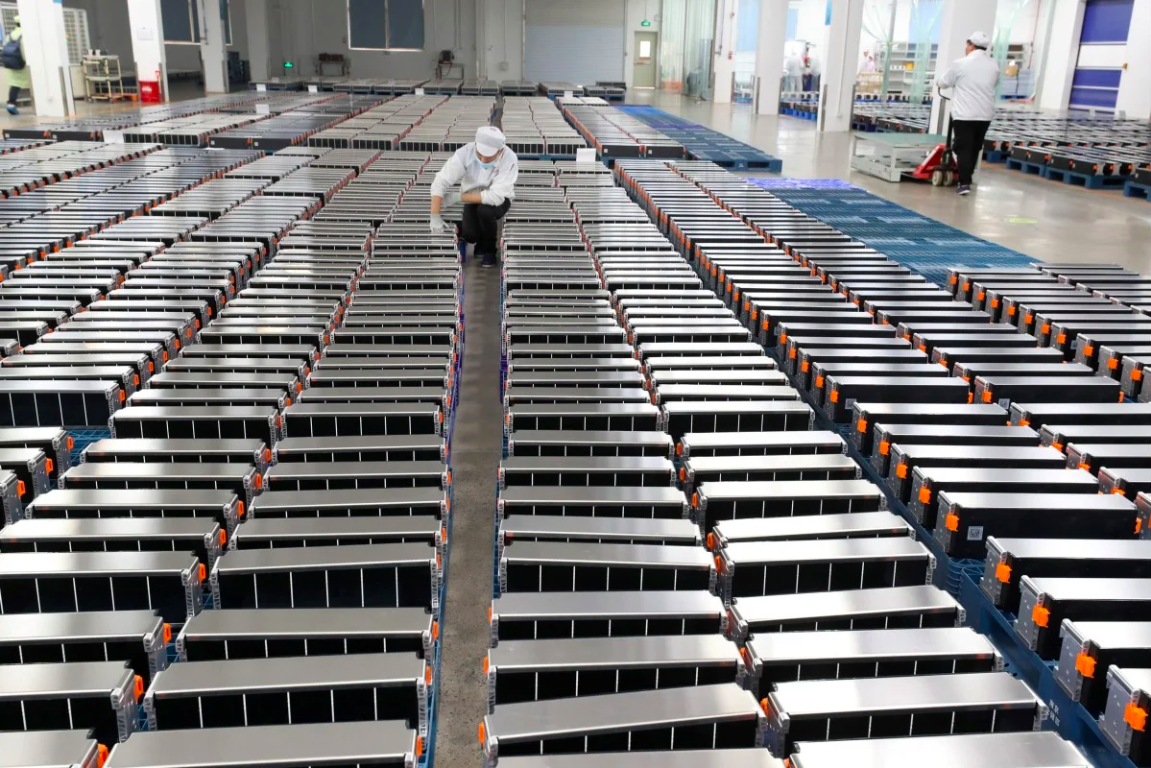

Leader in battery production

With complete industrial chains, China also leads the production of lithium-ion batteries, reaching 890 gigawatt-hours between January and October 2024, an increase of 16% compared to the previous year. During the same period, more than 200 gigawatt-hours of batteries for energy storage and approximately 405 gigawatt-hours for new energy vehicles were produced.

Lin Boqiang, director of the Chinese Energy Economics Research Center at Xiamen University, highlighted that complete production chains guarantee greater competitiveness in the global market. The integration of cutting-edge technologies also drives innovation in the sector.

Global lithium market context

On the global stage, the Lithium Triangle — formed by Bolivia, Argentina and Chile — leads in reserves, with Bolivia having 23 million tons. Brazil, although it has smaller reserves, is the fifth largest producer of lithium, extracting 4,900 tons in 2024. Most of Brazilian lithium is exported to China, which uses it in the production of batteries, including for electric cars such as those of BYD.

With technological advances and new discoveries, China strengthens its position as a leader in the transition to renewable energy and the high-technology market.

“White oil” and global dynamics

Lithium, known as “white oil” for its importance in the development of green energy, has become one of the most sought after minerals on the market. Despite its discovery in the 19th century, it was only with the advancement of batteries that its reserves began to be intensively explored. In 2010, only 23% of extracted lithium was used in batteries, a percentage that jumped to 84% in 2023, according to data from the United States Geological Survey (USGS).

Impacts for Brazil

Although Brazil has more modest reserves, with around 800 thousand tons mapped, the country is the sixth largest producer in the world, with 4.9 thousand tons extracted in 2024. Brazilian production is concentrated in Minas Gerais and the Northeast, in rich regions in spodumene. Much of Brazilian lithium is exported to China, where the mineral is transformed into batteries.

The mining affairs manager at the Brazilian Mining Institute (Ibram), Aline Nunes, highlights that the combination of logistics, costs and quality allows Brazil to be a relevant player in the market. Furthermore, the Ministry of Mines and Energy invests in research to identify new reserves in the country.

With China’s rise in the global ranking of lithium reserves, the country reinforces its strategic position in the renewable energy sector, while at the same time challenging other major players, such as Australia and South America, to seek technological and geopolitical advances to maintain its relevance in the market.

Source: vermelho.org.br