Protesters held an act against the company’s contract with the Israeli government Google fired...

“Enia” Plan promoted meetings for sexual orientation and provided contraceptive methods for young Argentine...

Published 04/18/2024 16:18 | Edited 04/18/2024 18:04 Palestinian men arrested and stripped naked by...

Declaration comes after a series of criticisms from the owner of X against the...

Uri Berliner had been suspended since April 12 for publishing a text about the...

Published 04/18/2024 13:36 | Edited 04/18/2024 13:52 The MAGA movement changed its strategy after...

Governor also invited the pontiff to visit Rio Grande do Sul in 2026 to...

Bezalel Smotrich said the Israeli reaction should make Iranians regret the “moment they thought...

Published 04/18/2024 15:35 Image of a recent demonstration against the Milei government representing grandmothers’...

Head of Finance talks about expanding credit through institutions; says that this is Brazil’s...

Lim Ki-Mo is known for his “performances” and has been filmed on previous occasions;...

The company’s lawyers in Brazil state that they will only provide the STF minister...

Published 04/17/2024 15:41 | Edited 04/17/2024 17:41 Yichuan Cao/getty An ally of the international...

Published 04/17/2024 17:01 | Edited 04/17/2024 17:31 Minister Mauro Vieira and diplomatic representations at...

President Luiz Inácio Lula da Silva (PT) asked this Wednesday (17) that Brazil and...

Committee on Foreign Relations hears from Michael Shellenberger and Glenn Greenwald; watch live on...

Published 04/17/2024 18:53 04/17/2024 – President of the Republic, Luiz Inácio Lula da Silva,...

In the first 2 months of the year, sector growth was 7%; retail also...

After almost 7 years of sanctions against the Venezuelan economy, the United States issued...

Uri Berliner, who has been a public radio journalist for 25 years, was suspended...

The bank reports EPS (earnings per share) of US$0.83 in the 1st quarter; revenue...

The Landless Rural Workers Movement (MST) organizes a week of events in Caracas, to...

President Nicolás Maduro also ordered the closure of consulates in Quito and the country’s...

Foreign Minister Israel Katz wants to “contain and weaken” the Iranian government Israeli Foreign...

President Luiz Inácio Lula da Silva’s trip to Colombia will have three important axes...

Flights were suspended for around 25 minutes this Tuesday morning (16 April) due to...

President classifies episode as “unacceptable” during Celac’s virtual summit to address the situation this...

Published 04/16/2024 15:40 | Edited 04/16/2024 16:39 Accompanying Cariola at the table are independent...

The diplomatic crisis generated by the invasion of the Mexican embassy in Quito by...

Initial expertise indicates that the documents and objects found next to the bodies were...

Published 04/16/2024 16:28 | Edited 04/16/2024 16:48 Foto: Ricardo Stuckert / PR This Tuesday...

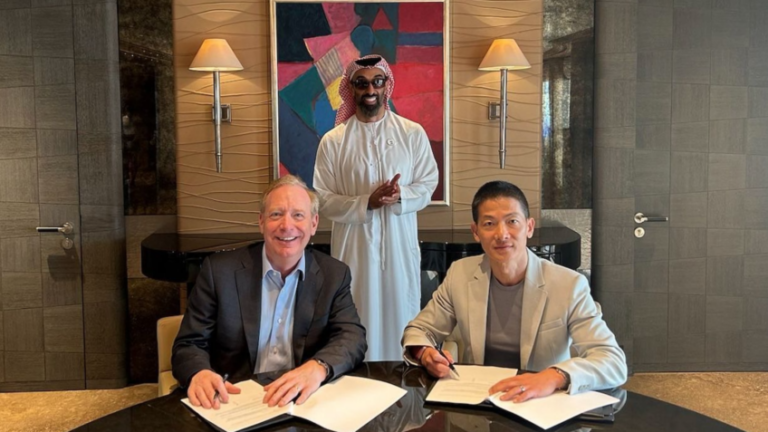

With the application, the president of Microsoft will join the Board of Directors of...

The president, Luiz Inácio Lula da Silva, travels this Tuesday (16) to Bogotá for...

Venezuela announced this Tuesday (16) the closure of consulates and its embassy in Ecuador,...

Annalena Baerbock, German Foreign Affairs, condemned Iranian attack on Israel with drones and missiles...

Upon reaching the six-month mark, the Israeli-led massacre of Palestinians in the Gaza Strip...

Published 04/16/2024 11:18 | Edited 04/16/2024 11:26 Driven by the rise in exports, China’s...

Group says Iran’s response to the Israeli country is “deserved” in the face of...

First lady says that President Lula gives her “complete autonomy” so she can do...

Eduardo Gradilone says he spoke with the country’s chancellor and reported that the Iranians’...

According to the White House, the US does not want to participate in a...

Published 04/15/2024 16:21 | Edited 04/15/2024 16:42 Billboard depicting Iranian ballistic missiles, with text...

A rubber bullet fired by police blinded a protester who took to the streets...

According to the IDF (Israel Defense Forces), around 300 drones and missiles were launched...

Iran’s military action against Israel this weekend in retaliation for the destruction of its...

Projectile was launched during Saturday’s offensive (Apr 13); despite being hit, Nevatim Air Base...

Make a delicious and beautiful Carrot Cake with Chocolate Icing and Sprinkles!

Argentina’s spiraling crisis affects all sectors. From formal company workers to civil servants, all...

Episode was on April 1st and left 8 dead; the next day, the Iranian...