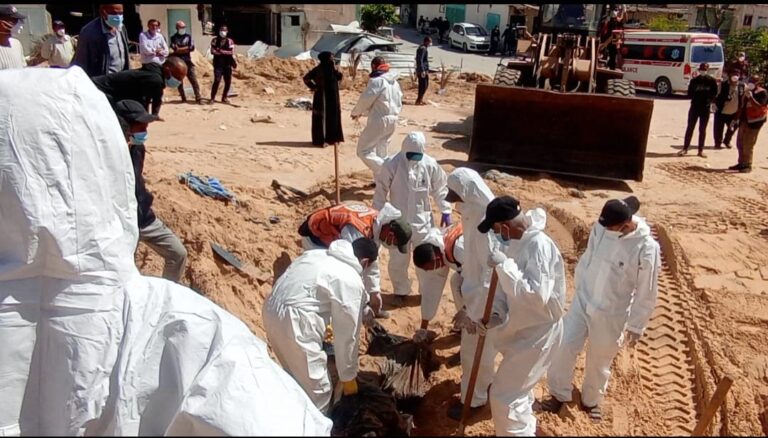

Published 04/22/2024 17:35 Image: QudsNen Last weekend, around 200 bodies were found in a...

Ismail Haniyeh, visited Istanbul this Saturday (Apr 20); Turkish president once again condemned Israeli...

Michael Shellenberger stated that the PF is investigating him as ordered by the minister,...

Published 04/22/2024 17:36 | Edited 04/22/2024 18:06 Next Thursday, Portugal celebrates a historic milestone...

Owner of X (former Twitter) commented on a Brazilian newspaper publication about Moraes’ loss...

Published 04/22/2024 18:48 Ecuadorians support severe measures to combat crime, but are against the...

PT President claims that businessman “openly attacked Brazilian sovereignty in favor of his interests”...

Strengthening the financing capacity of institutions of this type is one of the proposals...

“The New York Times Simulator” allows the player to create editions of the printed...

Published 04/22/2024 14:34 Drone footage following the Hamas attack shows traces of the desperation...

Brazil was the 4th country with the most demands met; data has not been...

On Thursday (April 18), the UN Security Council barred the accession of the Palestinian...

A similar maneuver was carried out by the USA, the United Kingdom and France...

Businessman responded to user who said that the broadcaster is “Brazil’s biggest problem” Businessman...

The 1st funding was made in 2023; country has a history of going to...

An editorial from Granma, official organ of the Communist Party of Cuba (PCC), reflects...

Note from the Brazilian Ministry of Foreign Affairs talks about “avoiding escalation” and does...

Make a Strawberry Stuffed Candy perfect for gifting and selling at Easter!

The case took place this Friday (April 19) in an area reserved for protesters...

Published 04/21/2024 1:41 pm President Volodimir Zelenski’s despair was not for nothing. While Russia...

The sale of Paramount Global to Skydance Media could take a turn, with the...

Businessman commented on a post about the document released by the US Congress that...

Two institutions and 4 people were penalized for alleged human rights violations against Palestinians...

North American currency was impacted by conflicts in the Middle East and the change...

In a publication, the deputy calls the businessman “Muchen” and, in English, praises him...

Removal is made after the country’s Cyberspace Administration made the request citing security concerns...

Without mentioning names, the STF minister states that “irresponsible” people linked to social media...

In the action, the Public Defender’s Office says that Musk’s statements on the platform...

Author of the offensive is unknown; Despite the damage caused to infrastructure, there is...

Published 04/19/2024 16:33 | Edited 04/19/2024 17:08 Photo: Reproduction Out of deference to the...

Book sparks controversy by suggesting a catastrophic epidemic among young people, writes Hamilton Carvalho...

Published 04/19/2024 18:11 | Edited 04/19/2024 19:02 Iran’s air defense systems were fired on...

Jury selection started on Monday (April 18); It is the 1st of 4 criminal...

Published 04/19/2024 18:26 | Edited 04/19/2024 18:59 The victory of the conservatives in the...

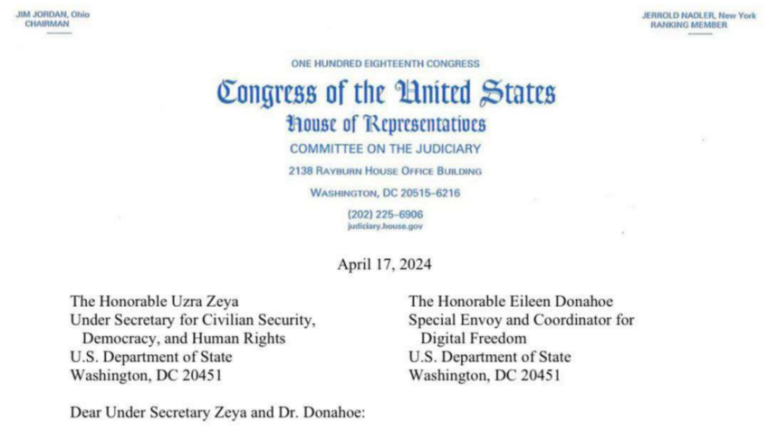

Collegiate requested documents exchanged between State Department employees and the North American diplomatic corps...

Published 04/19/2024 19:37 | Edited 04/19/2024 19:44 India witnessed a massive turnout to the...

Former Lava Jato prosecutor analyzed committee document from the North American Chamber of Deputies:...

Ideological coherence is a virtue, but a man’s head is sometimes insurmountable; read the...

Make a very fluffy and economical homemade bread with this recipe!

Published 04/19/2024 14:55 | Edited 04/19/2024 14:59 Photo: reproduction/social networks One of the most...

State of Israel is an artificial work, built from the beginning with deaths, expulsions,...

According to a committee document from the North American Chamber of Deputies, the minister...

Protesters held an act against the company’s contract with the Israeli government Google fired...

“Enia” Plan promoted meetings for sexual orientation and provided contraceptive methods for young Argentine...

Published 04/18/2024 16:18 | Edited 04/18/2024 18:04 Palestinian men arrested and stripped naked by...

Declaration comes after a series of criticisms from the owner of X against the...

Uri Berliner had been suspended since April 12 for publishing a text about the...

Published 04/18/2024 13:36 | Edited 04/18/2024 13:52 The MAGA movement changed its strategy after...

Governor also invited the pontiff to visit Rio Grande do Sul in 2026 to...

Bezalel Smotrich said the Israeli reaction should make Iranians regret the “moment they thought...